Intel Interim Co-Chief Expects CEO To Have Foundry Background, Stands By Forecast

Intel Corp (NASDAQ:INTC) interim co-CEO David Zinsner said he expects the next chief to have manufacturing and product expertise Reuters cites from the UBS technology conference on Wednesday.

Zinsner’s comments came after CEO Pat Gelsinger quit on Monday, failing to impress the board with his turnaround efforts.

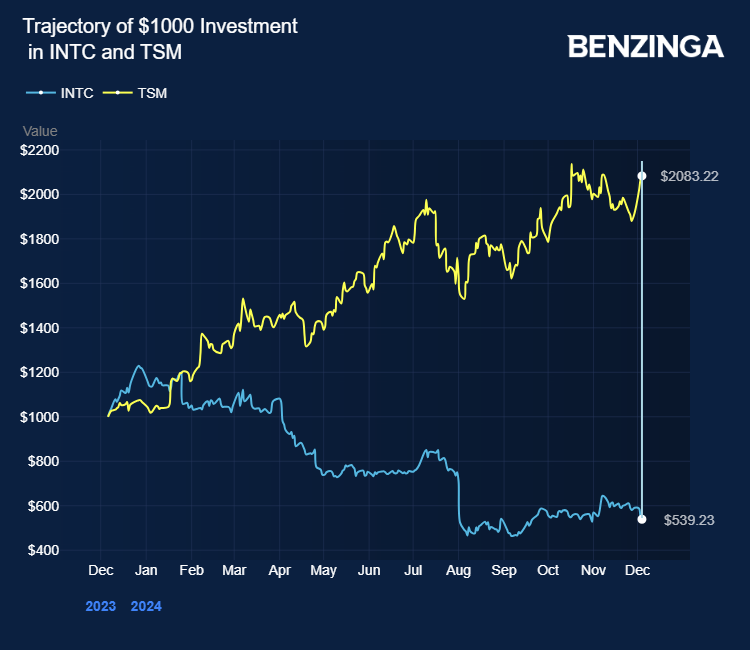

Intel stock is down over 54% year-to-date as it failed to tap technological shifts, including a shift to mobile devices and AI-centric computing akin to Taiwan Semiconductor Manufacturing Co (NYSE:TSM) and Nvidia Corp (NASDAQ:NVDA).

Also Read: Amazon Takes On Nvidia With Cheaper AI Supercomputers, Servers

Zinsner said Intel’s “core strategy” and outlook regarding the future of its PC and server business remain intact. The company continues to expect fourth-quarter revenue of $13.30 billion—$14.30 billion versus guidance of $13.81 billion.

The chipmaker had named CFO David Zinsner and general manager of Intel’s Client Computing Group Michelle Johnston Holthaus as interim co-CEOs while the board hunted for a new CEO.

The company’s list of potential candidates includes former director Lip-Bu Tan who reportedly left the company after differences with Gelsinger.

Intel’s head of foundry manufacturing and supply chain, Naga Chandrasekaran, emphasized the need for cultural change to become a successful foundry and semiconductor player. He expects Intel to offer samples of chips made with the new node in the first half of 2025.

Zinsner expects Intel’s foundry business to note better margins by 2025, mainly due to its Lunar Lake processors.

Truist Securities analyst William Stein and Benchmark analyst Cody Acree do not expect a management change to move the needle for Intel, which lagged behind Taiwan Semiconductor in manufacturing capacity and needed to include the AI accelerator opportunity. However, the potential breakup of Intel’s products and foundry business would deprive shareholders, and the separation of the foundry business could imply Intel parting with the $7.8 billion of CHIPS Act funding, as per the analysts.

Investors can gain exposure to Intel through First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL) and REX FANG & Innovation Equity Premium Income ETF (NASDAQ:FEPI).

Price Action: INTC stock closed lower by 3.79% at $21.13 at the last check on Wednesday.

Also Read:

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Briefs BZ Data Project Stock BattlesNews Top Stories Tech Media