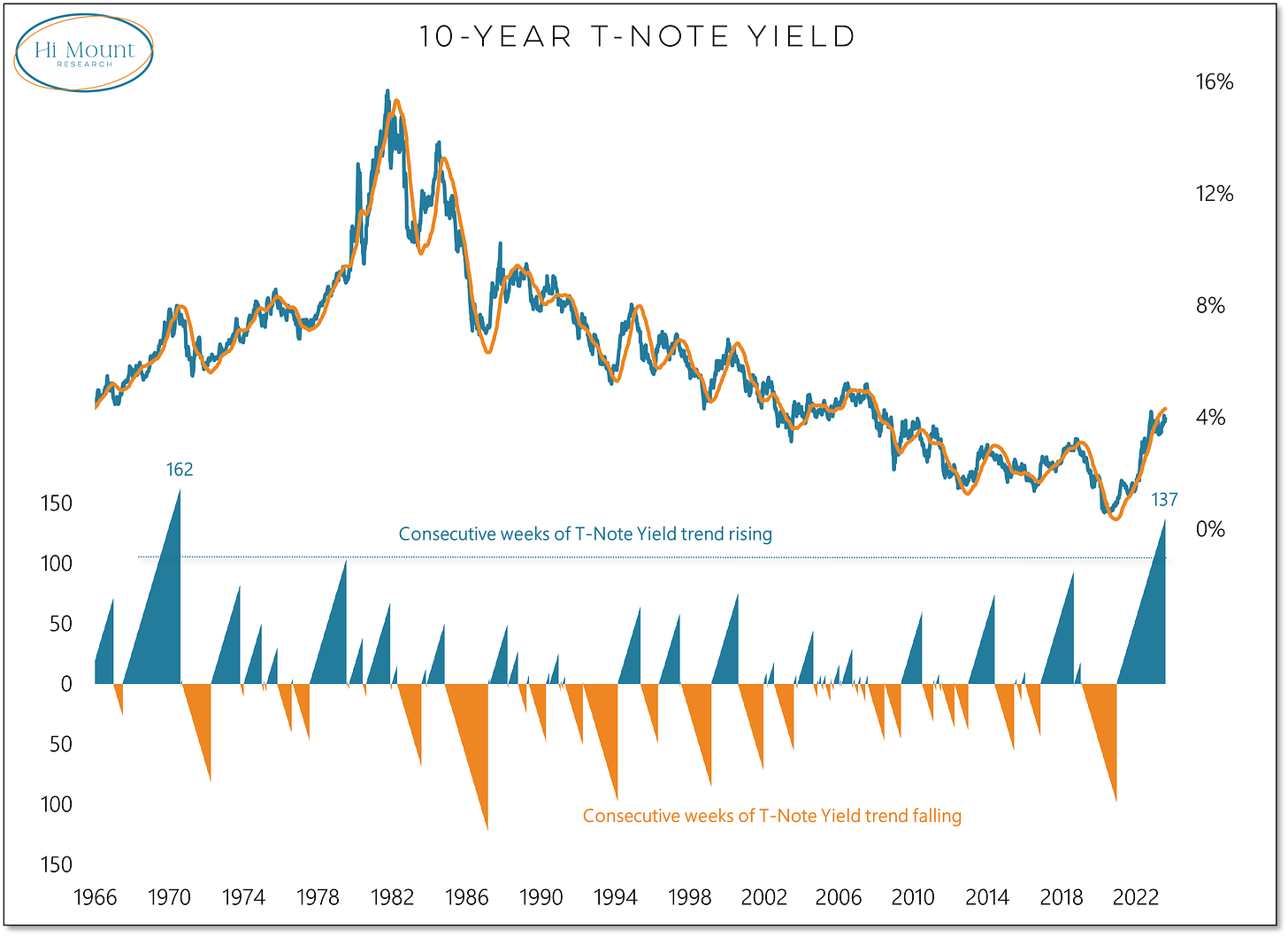

A New Paradigm For Bond Yields: Yields Climbing Toward Their Highs Should Not Be A Surprise Given The Direction Of The Underlying Trend

Key Takeaway: The persistence of the uptrend in bond yields continues to catch investors off guard, but yet the path of least resistance is higher.

More Context: The trend in the 10-year T-Note yield has been rising for 137 weeks in a row. That is the longest sustained rise since the 1960's. Given the direction of the underlying trend, yields pushing up to their recent highs should not come as a surprise. And yet the widespread expectation is that yields will move lower (not higher) from here. But to argue for that at this point is to make an enemy of the trend.

At some point the trend will roll over and yields will experience a meaningful decline. But keep in mind, the pattern of lower highs and lower lows in bond yields that persisted from 1982 to 2016 has already been broken. The 10-year yield made a higher high in 2016 and again in 2022 (and is on the verge of exceeding that again). Given the shift in the long-term trend environment, investors need to adapt to this new paradigm in which yields don't drop as far or for as long as they have in the past.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

Posted-In: Bond Yields contributors Expert IdeasBonds Markets General